Blog

Best State To Invest Real Estate In?

If you were given $1 million to invest today, where would you put it? In today’s market, the "pretty" choice is rarely the "profitable" one. To find the real winners, you have to look past the skyline views and look at the laws, the demographics, and the demand...

US vs. The World: Where Should You Actually Put Your Next $1M?

If you had $1,000,000 to deploy today, where would you put it? The world is full of "glamour" markets—Dubai, Monaco, London, New York. But when you look past the skylines and delve into the legal and tax frameworks, the choice becomes much simpler. In a "winner stays...

The Early-In Advantage: How to Beat Wall Street to the Best Real Estate

In the world of investing, everyone is obsessed with being "first." People chase the next "moon shot" crypto coin or the next viral AI stock, hoping to strike it rich before anyone else notices. But seasoned investors know a different truth: You don’t have to be first...

The G-Wagon Trap: Why Looking Rich Is Keeping You Poor

We live in a culture that is obsessed with the "flex." We’ve been conditioned to believe that success looks like a $250,000 SUV, a designer wardrobe, and a lifestyle funded by monthly payments. But if you look under the hood of most "successful" lifestyles, you don’t...

Why Successful Business Owners Shouldn’t Be Landlords

If you’ve spent years building a business or a high-level career, you’ve learned one thing the hard way: Time is your scarcest asset. Once you reach a certain level of success, the goal of investing changes. You aren't just looking for a return on your money; you are...

The Tax-Efficient Shortcut: Why the Wealthy Build While Everyone Else Buys

There is a fundamental "secret" in the world of high-stakes real estate that rarely makes it into the mainstream finance books. Most people are taught to be consumers of real estate. They save for years to buy an existing property, hoping that 3% annual appreciation...

Why “Buying Dirt” Is Better Than Buying Doors: The Wealthy’s Real Estate Secret

Most investors are taught a very specific, linear path: save your money, get a mortgage, buy a rental property, and deal with the "Three Ts"—Tenants, Toilets, and Trash. We’ve been conditioned to believe that the pinnacle of financial freedom is being a landlord. But...

5 Things to Know Before Getting Started in Real Estate

Real estate is one of the most effective and attractive ways to become wealthy. It promises outstanding opportunities, and more importantly, it has the ability to bring financial freedom. There is a learning curve however and if you are not prepared, and do not have...

Paying Zero Taxes by Investing in Real Estate?

" In this world, nothing can be said to be certain, except death and taxes." - Benjamin Franklin The earliest known tax was documented in Mesopotamia approximately 4500 years ago. People used to pay using livestock, which was one of the prominent and acceptable...

Cash Flow is The Holy Grail?

Cash flow is the backbone of real estate. It's like the holy grail. Which, while not completely tangible itself, brings happiness, luck, peace, and fullness to your life. Investing in real estate might be the smartest decision could ever make. But to get the success...

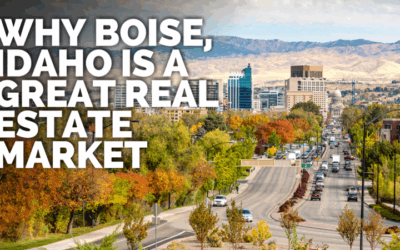

Why Boise, Idaho is a Great Real Estate Market

The city of trees - let's look at Boise, ranked #1 in the top 100 best places to live in 2019. Boise, located in Idaho, became a magnet in recent years. According to Forbes, it is the fastest-growing city in the United States. Its wilderness exceeds the size of the...

What is an Accredited Investor?

After several years of the hardworking experience, you decided to invest in something valuable. Despite the fact you had a great year and earned a considerable amount of money, you might find out that not all projects are accessible to you. What makes you eligible?...