Our Investment Process

We make real estate investing simple, strategic and stress-free. Here’s how we do it:

Cutten Industrial

1. Discover

The first step in Shannon’s process is uncovering high-value opportunities in recession-resistant markets. This starts with a deep market analysis—studying demographics, job and wage growth, housing shortages, and brokerage data to pinpoint areas with strong fundamentals.

Shannon doesn’t stop at surface-level numbers. His team layers in deal-level analysis, reviewing property financials, projected rent growth, expense ratios, and renovation or development potential. Alongside this, due diligence ensures the assumptions are sound—everything from lease audits and property condition reports to third-party market studies and stress-testing financial models.

By blending market intelligence with rigorous deal vetting, Shannon identifies and offers prime opportunities in alternative assets.

Greenhurst Meadows

2. Connect

The next step is all about aligning investors with the right opportunities. Every investor has different expectations for cash flow, appreciation, tax benefits. We take time to understand each investor’s goals, timeline, and risk tolerance and partner with you on projects that compliment your goals. This connection stage is more than matchmaking—it’s a strategic fit check.

Colorado Commons

3. Analyze

The final stage is where investors step into truly passive ownership—receiving hands-off, tax-optimized income while Shannon and his team manage the heavy lifting. By this point, each deal has been thoroughly underwritten, stress-tested, and structured to balance cash flow, appreciation, and tax efficiency.

Shannon typically targets mid-to-upper 20% returns on 24–48 month hold periods, with built-in buffers for market shifts. Once capital is placed, his team oversees every aspect of asset management—leasing, renovations, expense controls, and financial performance. Regular reporting and transparent updates keep investors fully informed without requiring their day-to-day involvement.

This stage transforms real estate from an active burden into a wealth-building vehicle, allowing investors to benefit from professional management, stable income, and long-term value creation.

Investment Opportunities

Our projects can be your stepping stone into the world of Real Estate Investing. We offer a broad range of classes and asset types so no if you’re a complete beginner or a seasoned pro, there’s an opportunity for you to be part of.

Capital City Growth Fund

Beat Traditional Investments with 11-15% Annual Returns

Finally, an investment that delivers both high returns and security. The Capital City Growth Fund revolutionizes real estate investing by solving the five critical problems plaguing traditional investments: unpredictable returns, downside risk, tax inefficiency, limited liquidity, and market volatility.

Why This Changes Everything

While REITs struggle with 4-7% returns and syndications lock up your capital for years, the Capital City Growth Fund delivers contract-based 11-15% annual returns through its innovative debt structure. As a lender, not an owner, you receive priority in the capital stack.

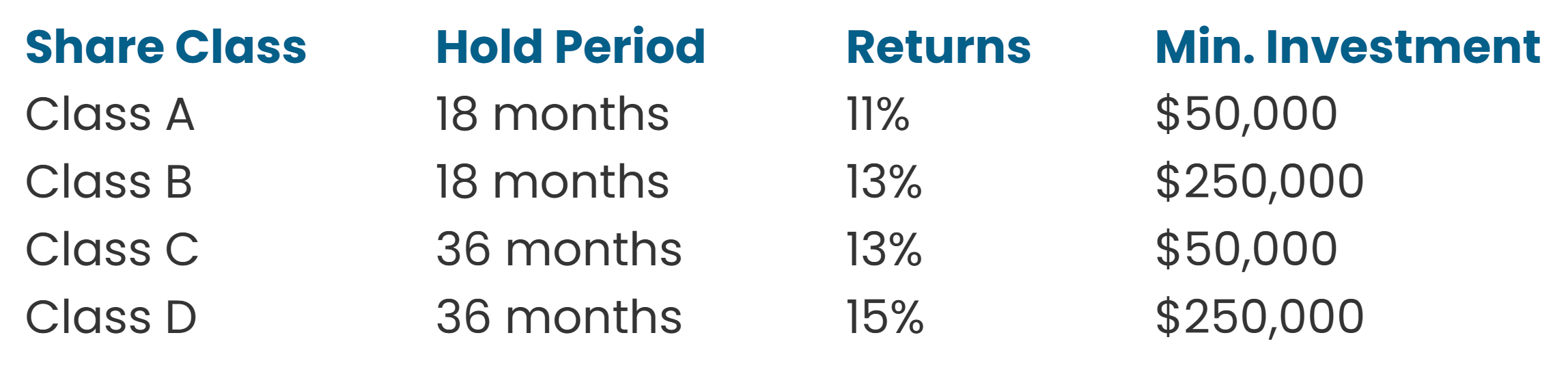

Four Flexible Investment Classes

The Game-Changing Advantages

Predictable Returns

Fixed interest payments secured by real estate collateral.

Downside Protection

Multiple security layers including conservative loan-to-value ratios.

Flexible Liquidity

Choose your time horizon from 18 to 36 months.

Tax Efficiency

UBIT-free structure for retirement accounts with simplified 1099 reporting.

Market Stability

Debt investments historically outperform equity during downturns.

Perfect for Retirement Accounts

Specifically designed for self-directed IRAs and Solo 401(k)s, avoiding UBIT taxes while providing tax-deferred growth and alternative asset exposure.

Read More About Capital City Growth Fund

Limited opportunities available. The best projects are captured by sophisticated investors with proven track records.

Shanon Robnett’s Multi-Family & Industrial Syndications

Transform Your Investment Portfolio with Proven 25% Average Returns

Stop accepting mediocre returns. While REITs struggle with 4-7% yields, Shannon Robnett’s multi-family and industrial syndications have consistently generated 25% average internal rate of return of over 35+ years through his proven ground-up development strategy.

The Game-Changing Advantages

$425 million in successful construction projects

$28 million in profits delivered to investors

IRR vs Returns: Mid to upper 20% returns in 24-48 month cycles

Completed vertical integration eliminates third-party risks

Two Proven Investment Strategies

Multifamily Syndications:

Ground-up development delivering superior returns like Central Park Commons (114% total ROI in 4 years) and Colorado Commons (39% ROI in 18 months) through conservative underwriting and permanent financing.

Industrial Syndications:

The “bond of real estate” featuring triple-net lease structures, 5-10 year leases with built-in increases, business-quality tenants with personal guarantees and recession-resistant cash flows.

Your Investment Advantages

- $50,000 minimum investment for accredited and sophisticated investors

- Layered downside protection built on trusted, data-driven underwriting

- Identify and mitigate risks at every stage – even in worst-case scenarios

- Powerful tax benefits

- Vertically integrated

- Exclusive access to off market opportunities

Learn More About Investing in Syndications

Limited opportunities available. The best projects are captured by sophisticated investors with proven track records.