Once you have completed your exploration of real estate and have decided that multifamily syndication is the best investment option for your needs, its time to get the knowledge you need to do your due diligence and pick the best deal. You need to know your options. Do you want to control, or do you want passive income? Are you ok with being liable if something goes wrong with the deal or do you want to protect yourself and have little to no liability? Do you know the difference between a General Partner (GP) and a Limited Partner (LP)?

Real estate syndication tends to bring in high rates of returns for investment opportunities that are normally closed to individual investors. Syndications often allow non-accredited individuals to participate in the offerings, making investing in commercial real estate attainable for everyone.

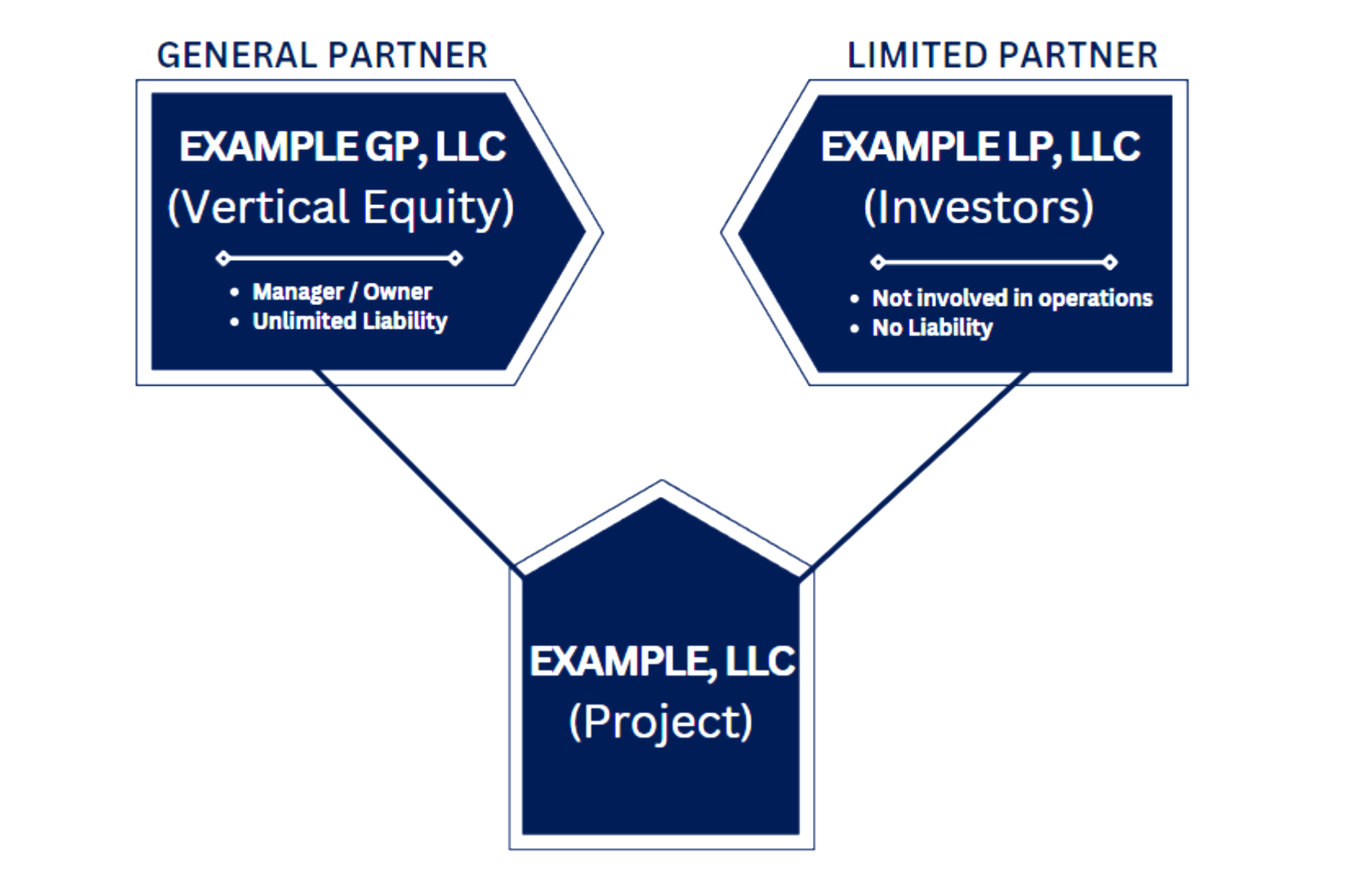

Multifamily syndication is a partnership that can have many moving parts, a general partner, limited partner, commercial real estate broker, a real estate and securities attorney, and even a property management company. But we will be focusing on the two that comprise most. GPs and LPs.

Who is The General Partner and what are their duties?

Plainly explained – the general partner or simply GP is an owner of the partnership, who is responsible for collecting money from different investors and managing the properties from top to bottom. Obviously, multifamily properties are complicated and have many moving parts.

This is why general partnerships, in many cases, includes multiple people who are all responsible for different aspects of the property management such as:

- Selecting an investment market;

- Guiding the passive investors;

- Distributing profits equally to investors;

- Finding clients;

- Working with clients of the property or simply tenants;

- Working with banks;

- Being involved in the daily management;

Basically, taking care of everything which needs to be done for the investment and the property to succeed and to generate the best possible returns for the property’s partners.

Who are The Limited Partners and what are their duties?

Limited partner or LP is a term used in apartment syndications for passive investors. Typical syndications will have a business structure where investors will own shares as a Limited Partner in the LLC that partners with the GP’s LLC in the deal. Not only does this limit your liability but it also offers passive income to you in your position as the LP.

As you can see, Limited Partners are truly passive investors who put their capital into the property while having no direct responsibility for managing them, which means they are free from all the responsibilities and liabilities of a GP.

Invest Confidently with Shannon Robnett

Growing your portfolio isn’t just a technical detail—it’s the key to aligning your investment strategy with your personal financial goals. At Shannon Robnett Industries, we bring decades of experience structuring both types of opportunities, with a proven track record of helping investors build wealth through carefully vetted, tax-advantaged real estate projects. Whether you’re seeking steady income through debt or long-term growth through equity, our team is here to help you make the right move.