NEW PASSIVE INVESTMENT OPPORTUNITY

CAPITAL CITY REAL ESTATE FUND

Think Beyond The Traditional Investment Options

Our Track record

Returns

Experience

Projects

Management

Raised

Shannon keeps the excitement up while teaching a powerful topic like real estate with information, tips, strategies, and valuable guests. One of the most education investing podcasts on our podcast network.

– Bruce

INTRODUCING

CAPITAL CITY REAL ESTATE FUND PORTFOLIO

Greenhurst Meadows

- 60 units

- 3.09 acre

- Raise $3.3M

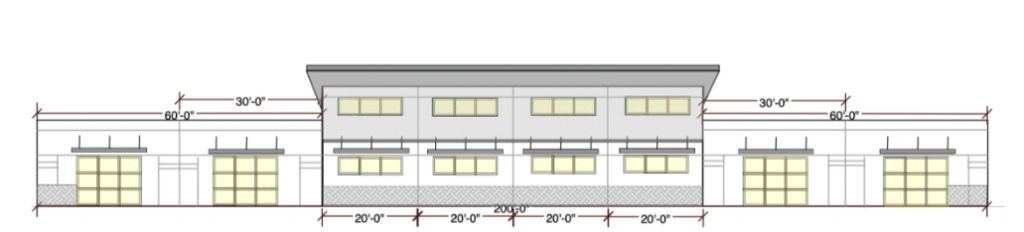

Franklin Industrial

- 20,000 SF

- $950K Raised

Cole Rd: Currently commercial office/mix use space

- 39,970 SF rentable space

- 100% occupancy

- Raised $2.4MM QOZ

- planned 170-unit

- Apartment complex developed at $40K per door.

Summertown

- Raise $11.6MM

- 191 Row Houses and Garden Apartment Development

Airport Plaza

- 44,000 SF commercial office building

- Raise $3.2MM

Highlands

- 13 Units (12 Multifamily + 1 Single Family)

- $864K Raised

Hickory Flex

- 28,000 SF

- Raised $850K

INVEST LIKE A PARTNER!

Ever wanted to invest in real estate, but don’t have the time or experience?

NOW, you could invest passively in large scale multifamily real estate that is inaccessible to majority of investors!

To take it a step further, invest alongside experienced operators and share in return economics just like a General Partner!

Sign up now and learn more about our

CAPITAL CITY REAL ESTATE FUND!

INVESTMENT HIGHLIGHTS

- The first tranche will be $20M with an overall fund capital of $100M

- Target IRR is 16%

- Anticipated cash-on-cash Returns will be 10-13%

- 70/30 Equity Split

- We are targeting 2000 & newer MF low-risk stabilized assets

- Multiple assets in multiple locations with a focus on cash flow to lower risk.

Why invest in Capital City REAL ESTATE Fund

PASSIVE INVESTING

We execute a specific, step-by-step business plan for every asset we acquire or construct.

We get to work while you get regular updates on your investment and quarterly rental income distributions.

DIVERSIFICATION

Balance your portfolio.

The 4 significant benefits of investing in real estate:

1. Cashflow

2. Amortization

3. Forced appreciation

INFLATION HEDGE

Real estate investments are considered protection against inflation.

When the prices of goods and services are rising, home values and rents typically increase, too. Investment properties can provide you with rising monthly income and appreciation to help protect you financially.

BENEFITS OF PASSIVE INVESTING IN THE CAPITAL CITY REAL ESTATE FUND

DIVERSIFICATION

Investor equity is invested over multiple acquisitions in multiple markets, with individual property business plans and hold periods.

RISK MITIGATION

Investment over multiple projects offers the ability to reduce risks while offering the potential for higher returns.

LEVERAGE

Leverage our vast experience, financial sponsorship strength, and capital aggregation to invest in otherwise unobtainable, high-value apartments with high returns.

TAX-ADVANTAGED INVESTING

Enjoy the potential for tax advantages such as 100% bonus depreciation, accelerated depreciation/cost segregation, passive income tax treatment, IRA investing, and death tax benefit.

PRINCIPAL REDUCTION

Through the life cycle of the syndication, rental income from the property pays down debt service. Upon the sale of the property principal reductions will be returned to investors.

RECESSION & INFLATION RESISTANT

Regardless of the economy, people still need a place to live. Class A and B rental properties have done historically well in past recessions and in periods of high inflation.

OPPORTUNITIES IN A RECESSION

CONDITIONS BUT BECAUSE OF THE MARKET CONDITIONS!

HOW SHANNON ROBNETT INDUSTRIES SELECTS MARKETS

DEMAND AND SUPPLY

We closely monitor the supply of local apartments to ensure that it does not increase vacancy rates and negatively affect rentals.

SALES TRENDS

We regularly monitor local sales to compute cap rates and decide if we are on track to meet our estimates.

RENT GROWTH

One of our important indications is the 5-year rent growth estimate. This figure is calculated using a strong proprietary approach.

EMPLOYMENT

We seek metros and submarkets that create a considerable number of high-paying employment, resulting in a healthy local economy.

WHAT ARE OUR VALUES?

INTEGRITY

Real estate investment involves an astonishing amount of local, state, and federal regulation. With strict attention to detail and an honest approach to business, SRI complies with these regulations and brings peace of mind to investors.

PASSION

Making wise investments is a weighty job, especially if you’re working on unfamiliar ground. SRI welcomes some of that burden because of our deeply seated passion for this industry. We like working on this ground, in part because we’ve had such success navigating it for so many years. We enjoy sharing the benefits of this passion with our clientele.

EXCELLENCE

SRI takes the initiative to perform at the highest level as we help you achieve your financial goals. We do this by implementing the very best investment strategies on your behalf through innovation, teamwork, and entrepreneurial spirit. We don’t do anything halfway. We do it honestly and exceptionally, or we don’t offer to do it at all.

EXPERIENCE

A founder with over 25 years of personal and hands on development and construction experience. Combine that with a hand picked staff to create a second to none investor experience.

MEET THE TEAM

SHANNON ROBNETT