TARGET IRR

ANTICIPATED RETURNS

OVERALL FUND CAPITAL

PREFERRED RETURNS

– Bruce

Ever wanted to invest in real estate, but don’t have the time or experience?

NOW, you could invest passively in large scale multifamily real estate that is inaccessible to majority of investors!

To take it a step further, invest alongside experienced operators and share in return economics just like a General Partner!

Sign up now and learn more about our

CAPITAL CITY REAL ESTATE FUND!

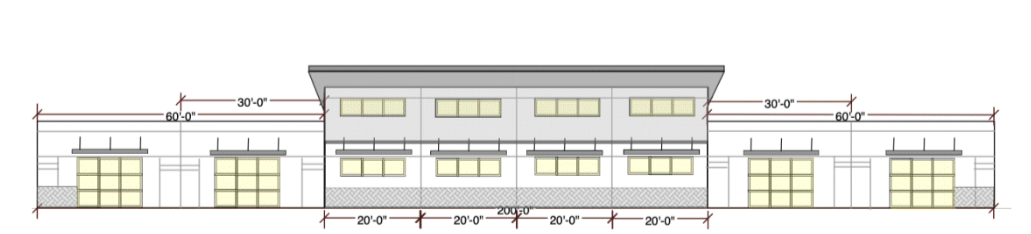

We execute a specific, step-by-step business plan for every asset we acquire or construct.

We get to work while you get regular updates on your investment and quarterly rental income distributions.

Balance your portfolio.

The 4 significant benefits of investing in real estate:

1. Cashflow

2. Amortization

3. Forced appreciation

Real estate investments are considered protection against inflation.

When the prices of goods and services are rising, home values and rents typically increase, too. Investment properties can provide you with rising monthly income and appreciation to help protect you financially.

Investor equity is invested over multiple acquisitions in multiple markets, with individual property business plans and hold periods.

Investment over multiple projects offers the ability to reduce risks while offering the potential for higher returns.

Leverage our vast experience, financial sponsorship strength, and capital aggregation to invest in otherwise unobtainable, high-value apartments with high returns.

Enjoy the potential for tax advantages such as 100% bonus depreciation, accelerated depreciation/cost segregation, passive income tax treatment, IRA investing, and death tax benefit.

Through the life cycle of the syndication, rental income from the property pays down debt service. Upon the sale of the property principal reductions will be returned to investors.

Regardless of the economy, people still need a place to live. Class A and B rental properties have done historically well in past recessions and in periods of high inflation.

We closely monitor the supply of local apartments to ensure that it does not increase vacancy rates and negatively affect rentals.

We regularly monitor local sales to compute cap rates and decide if we are on track to meet our estimates.

One of our important indications is the 5-year rent growth estimate. This figure is calculated using a strong proprietary approach.

We seek metros and submarkets that create a considerable number of high-paying employment, resulting in a healthy local economy.

Real estate investment involves an astonishing amount of local, state, and federal regulation. With strict attention to detail and an honest approach to business, SRI complies with these regulations and brings peace of mind to investors.

Making wise investments is a weighty job, especially if you’re working on unfamiliar ground. SRI welcomes some of that burden because of our deeply seated passion for this industry. We like working on this ground, in part because we’ve had such success navigating it for so many years. We enjoy sharing the benefits of this passion with our clientele.

SRI takes the initiative to perform at the highest level as we help you achieve your financial goals. We do this by implementing the very best investment strategies on your behalf through innovation, teamwork, and entrepreneurial spirit. We don’t do anything halfway. We do it honestly and exceptionally, or we don’t offer to do it at all.

A founder with over 25 years of personal and hands on development and construction experience. Combine that with a hand picked staff to create a second to none investor experience.