Unlocking Real Estate Investment:

HOW TO JOIN THE GAME WITH $50,000

Introduction

Many people believe that investing in real estate is an exclusive club reserved for the wealthy, requiring hundreds of thousands of dollars for a mortgage down payment. However, the landscape is changing, and the opportunity to invest in real estate with as little as $50,000 is becoming a reality, even through your IRA. The game-changer? Real estate syndication.

Watch the Video

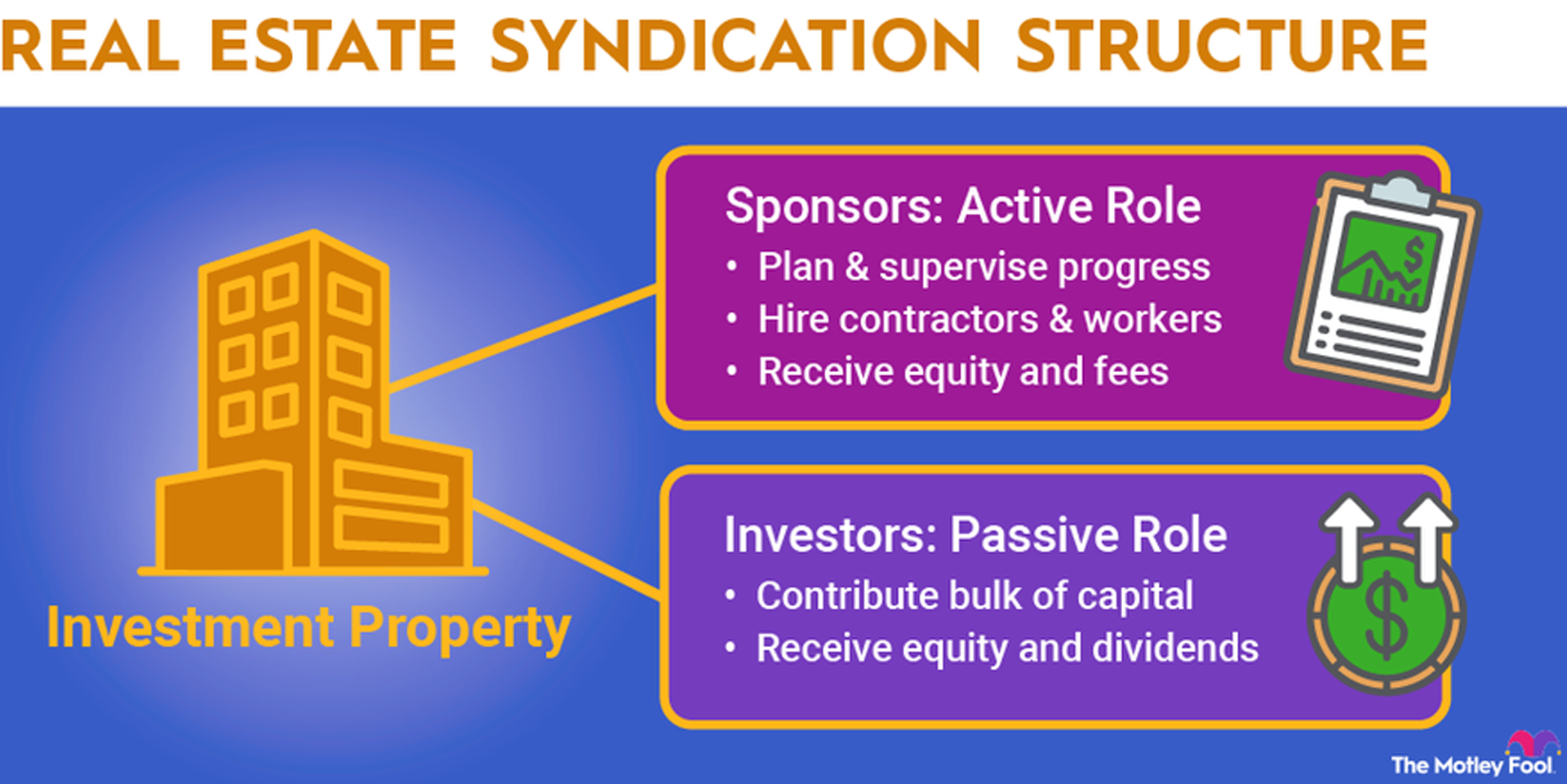

Understanding Real Estate Syndication

Real estate syndication is akin to a team of investors pooling their funds together, working towards common goals. In simpler terms, it’s a partnership where the general partner handles all the management aspects of the asset, while limited partners contribute funds with a more focused and limited role.

Breaking Down Barriers

Traditionally, real estate investment required substantial capital, making it accessible only to the affluent. With the average home costing around half a million dollars and banks typically demanding a 20% down payment, this posed a significant hurdle for most potential investors. Real estate syndication has shattered these barriers, allowing investors from all income brackets to participate in the real estate market as a team.

Global Accessibility

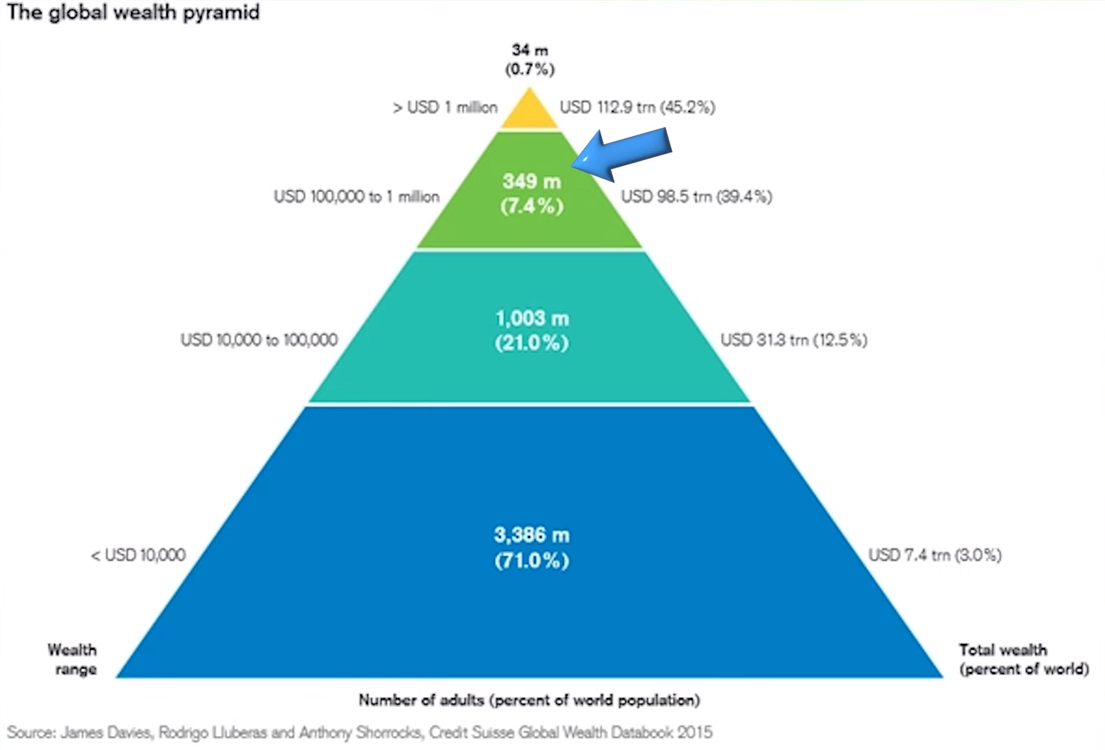

Before real estate syndication, a mere 8% of the global adult population had wealth exceeding $100,000. Considering the reluctance to invest their entire net worth in a single property, the actual percentage of eligible investors was even lower. However, the introduction of syndication has opened up real estate investment to over 1 billion adults globally, possessing wealth in the $10,000 to $100,000 range.

Wealth Distribution

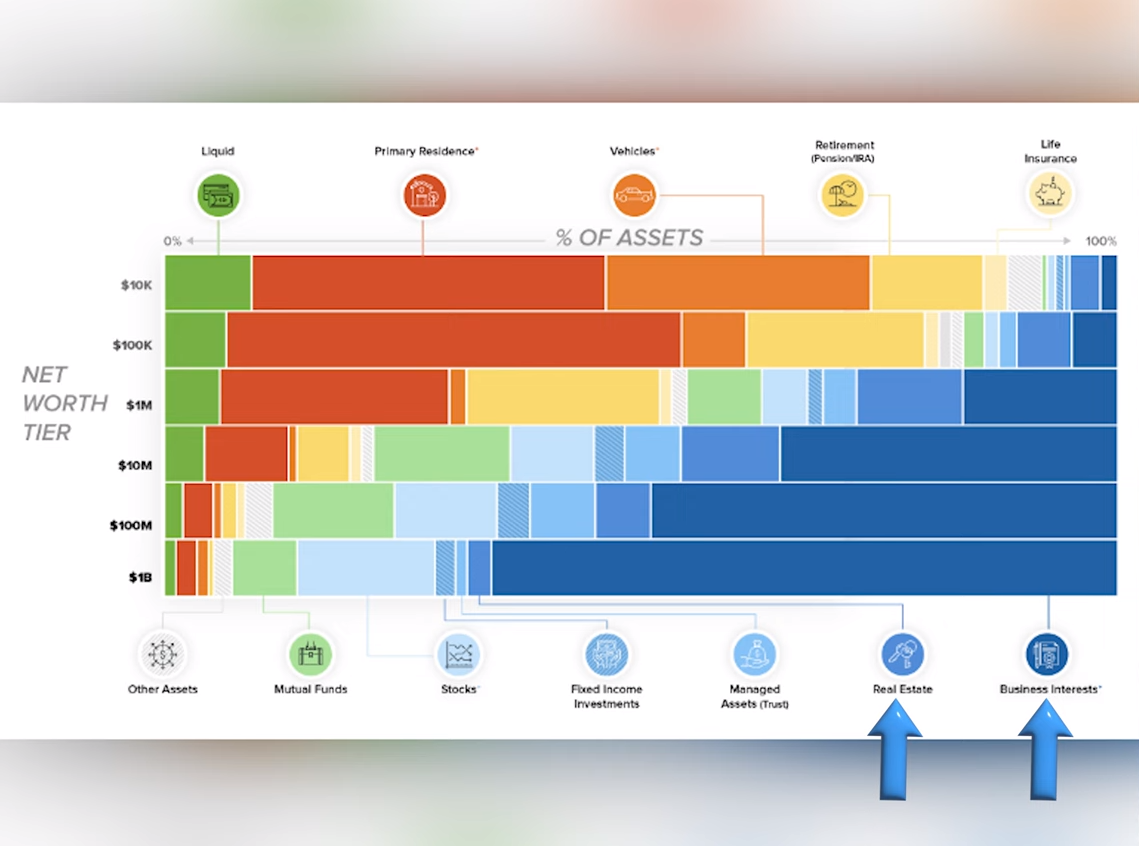

A significant aspect of real estate syndication is its potential to level the playing field by enabling more people to invest in appreciating assets. A look at the wealth distribution among billionaires reveals that over 60% of their wealth is stored in assets such as businesses and real estate. In contrast, individuals with less than $10,000 in net worth predominantly hold their wealth in cash, which is susceptible to inflation.

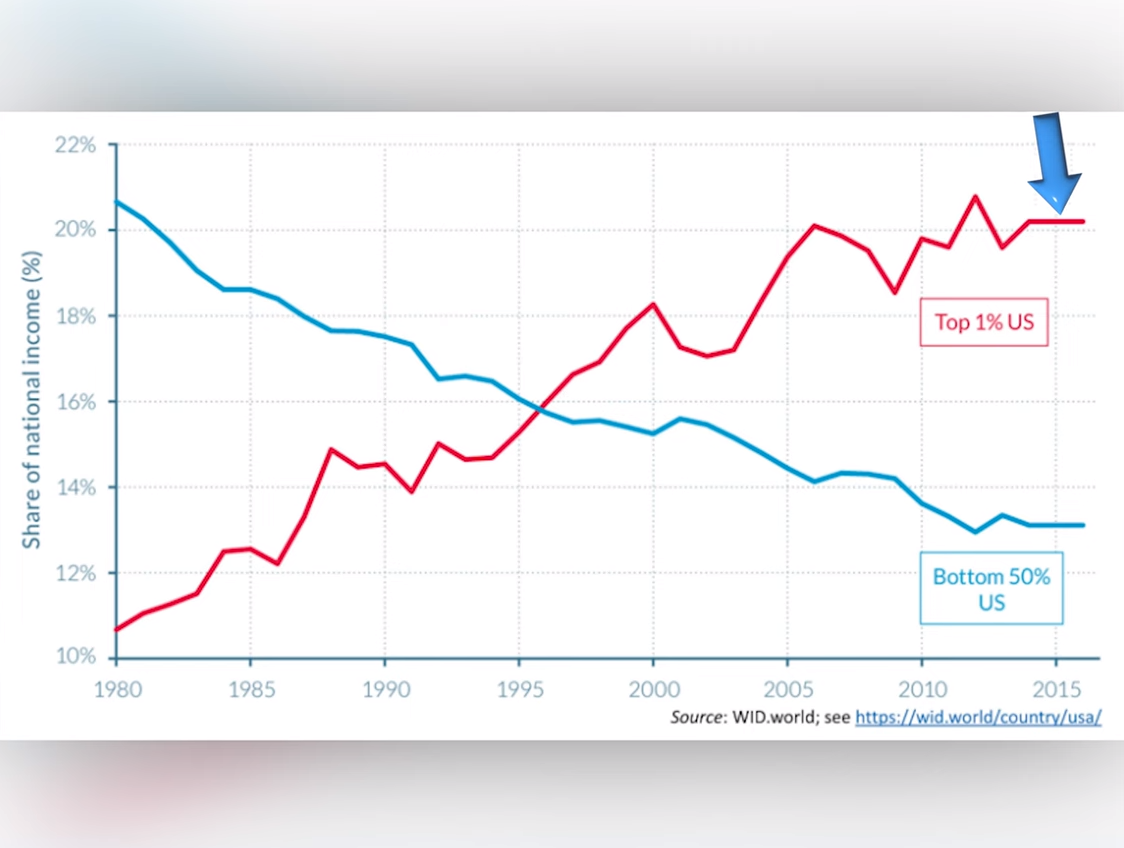

The Rich Get Richer

Historical data since the departure from the gold standard in 1971 emphasizes the wealth gap. Asset prices, driven by appreciation and income, have consistently outperformed cash. The chart showcasing income growth further highlights the increasing wealth disparity, with the top 1% experiencing significant growth compared to the stagnation of the bottom 90%.

Real Estate Syndication: A Game Changer for All

Real estate syndication emerges as a potential game-changer for those with limited capital. The ability to start investing with as little as $50,000 provides access to world-class assets, including apartment complexes and industrial projects, opening doors for the everyday investor.

Conclusion

In conclusion, real estate syndication is transforming the investment landscape, allowing individuals with modest means to participate in the wealth-building potential of real estate. The shift from traditional barriers to entry to a more inclusive model signifies a positive change in the dynamics of wealth creation. If you’re intrigued by the possibilities of real estate syndication, contact us for more information and consider joining a team of like-minded investors.