5 Ways To Build Massive Wealth Without Wallstreet

Best Guide To Generating Passive Income

Download Our Free E-book

Download our

Free

Ebook

Download our free ebook, 5 Ways To Build Massive Wealth Without Wallstreet

FROM SHANNON

I spend a lot of time talking with both my current investors and new ones and I am constantly getting asked one question more than any other.

“How do I know who is a legit operator?”

I have been in the real estate business for over 27 years and have done over $350M in transactional volume in 5 states, one commonwealth, and one other country.

And while all real estate is similar, it’s all extremely nuanced. So how do you figure out who knows enough to handle your money?

I have seen the good, the bad, and the ugly in my time, and I wanted to share with you from both personal experience and observation what I feel are the “absolute NO GO” signs to watch out for.

These are things that I believe in strongly enough that they are total deal breakers. I mean, I would not walk I would RUN from a deal if I saw one of these.

You should not allow your hard-earned money to be anywhere near a deal with one or more of these.

Red Flag #1

THE PART-TIMER

- Real Estate Syndication is not a hobby. It is a business and must be treated like a business.

- You worked hard to have the income to invest and should not want someone who is not all-in to manage your investment dollars.

- Want to keep reading?

Red Flag #2

NO SUCCESSFUL BUSINESS HISTORY

- What did the syndication sponsor do before they were doing syndicated deals?

- Anyone can successfully work for others, but running your own business takes some extra.

- Want to keep reading?

Red Flag #3

NO SKIN IN THE GAME

- Does the Sponsor running the show and offering the deal have their own money in the deal?

- If their risk is commensurate, they will likely make better decisions for all of us in the deal.

- Want to keep reading?

Red Flag #4

NO PREFERRED RETURN

- Limited partners, LPs, do not take part in active management. This is the number one function of the General Partners.

- LPs are protected from losses beyond their original investment and any legal actions taken against the investment.

- Want to keep reading?

Red Flag #5

DISTRIBUTIONS AS RETURN OF CAPITAL

- When distributions are paid out, they should be classified as a return ON capital rather than a return OF capital.

- Remember, Return on Capital is the amount of money you receive each year as the product of your initial investment.

- Want to keep reading?

Our Track record

27

Years

Experience

23%

Average

Returns

$425M

Development

Projects

$120M

Assets under

Management

$55M

Capital

Raised

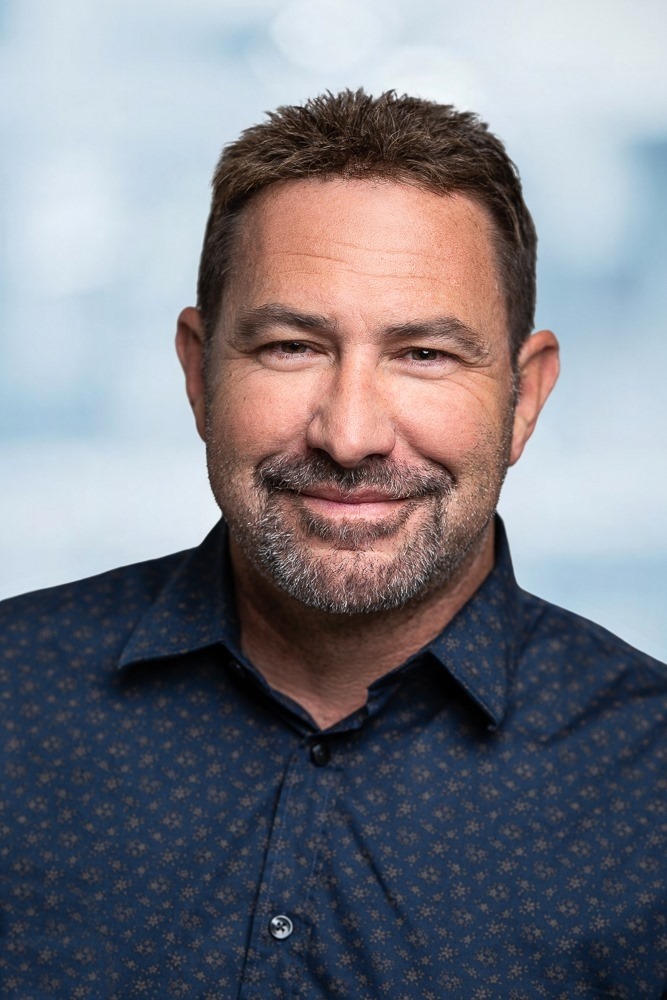

About The

Author

Shannon Robnett

CEO

Shannon has been in the real estate industry for 27 years. He has been involved from start to finish on over $350M in construction projects covering the gamut from multi family, professional office buildings to City halls, fire and police stations, schools, industrial and mini storage.

As a developer with over 25 years of personal and hands-on development and construction experience, few in this industry are more dedicated to delivering numerous passive income streams to their syndicate partners. Along with my knowledgeable and dedicated team, we at Shannon Robnett Industries (SRI) create a second-to-none investor experience.

Shannon keeps the excitement up while teaching a powerful topic like real estate with information, tips, strategies, and valuable guests. One of the most education investing podcasts on our podcast network.

– Bruce